3 Costly Mistakes Business Owners Make:

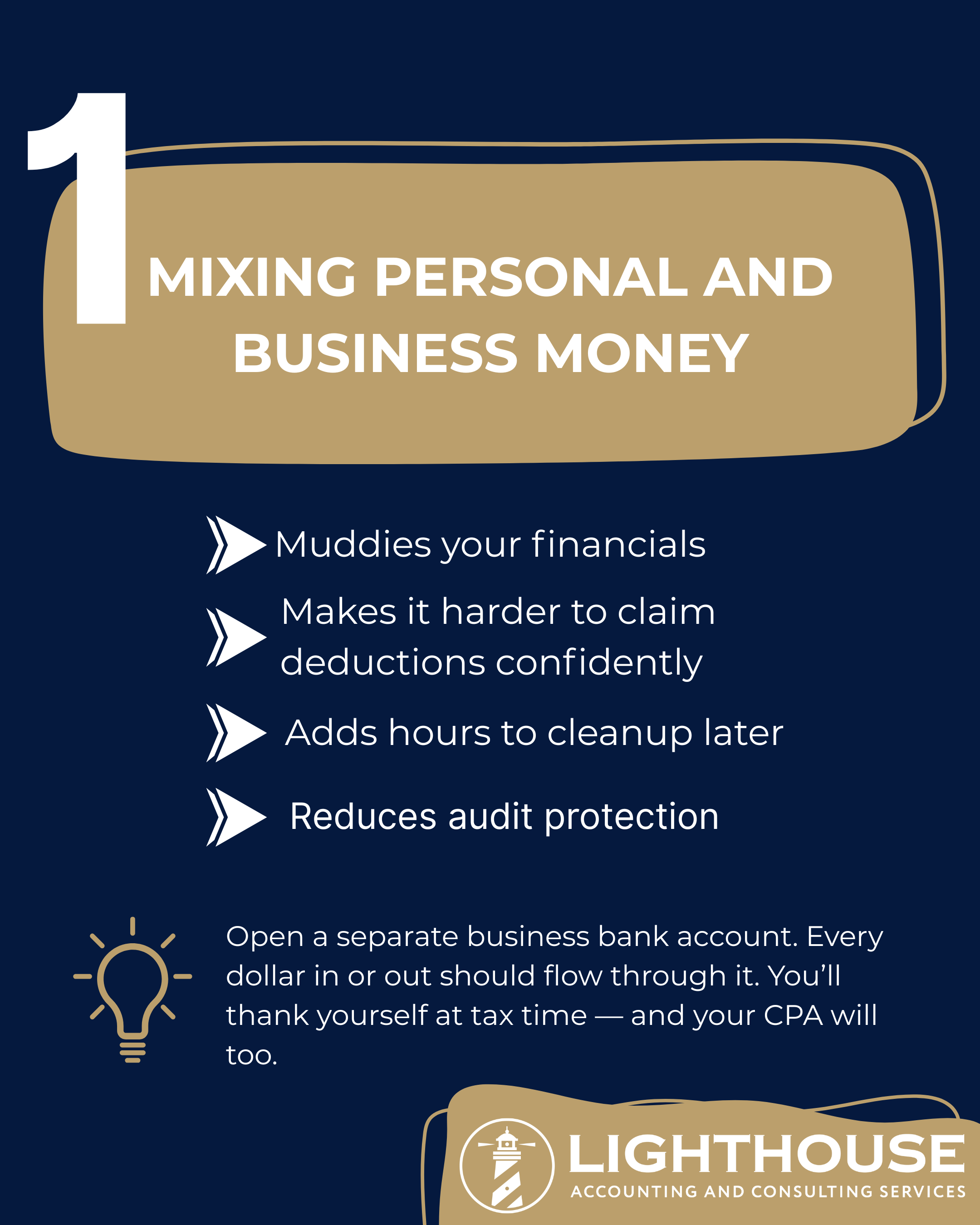

Mixing Personal and Business Money.

Mixing personal and business money is one of the fastest ways to create messy bookkeeping and expensive cleanup. When personal purchases run through the business account (or business expenses get paid from personal funds), it becomes harder to categorize transactions accurately and defend deductions if questions ever come up. It also blurs the line between the business and the owner, which can create headaches for entity compliance and financial reporting.

The fix is simple: separate accounts, separate cards, and a consistent process for reimbursements or owner draws. Clean separation makes your books clearer, your tax return cleaner, and your year-end work significantly less painful.

Skipping Quarterly Taxes.

Many business owners skip quarterly estimated tax payments because income feels uneven or it’s unclear what they’ll owe. The problem is that the IRS and most states generally expect tax to be paid as you earn income throughout the year, not all at once at filing time. When you wait, you’re more likely to face a surprise balance due and potentially underpayment penalties.

A basic quarterly tax plan keeps you in control: estimate income, set aside a percentage, and make scheduled payments. Even a “good enough” approach reduces stress, protects cash flow, and prevents your tax bill from turning into an avoidable financial event.

Confusing Cash with Profit.

Cash in the bank and profit are not the same thing, and confusing them leads to bad decisions. A business can show a profit on the books while cash is tight due to timing (slow-paying customers), debt payments, inventory purchases, or large upcoming expenses. The opposite can also happen: cash may look strong temporarily even when the business is losing money.

This is why strong business owners track both profitability and cash flow drivers—especially accounts receivable, accounts payable, debt, and owner draws. When you understand the difference between cash and profit, you price better, plan taxes better, and avoid the “I’m busy but broke” cycle.